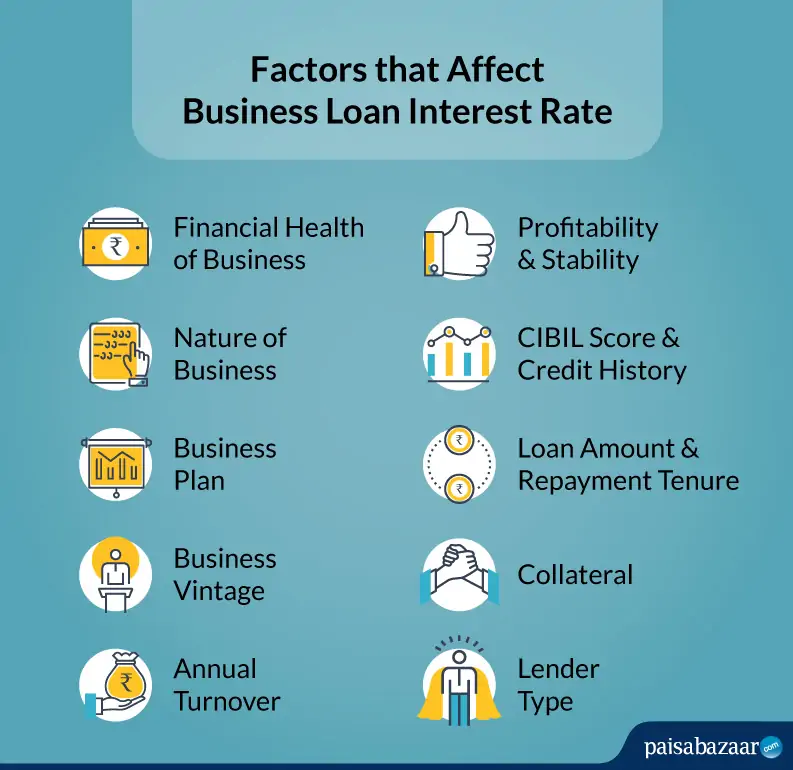

Your earnings and precise location of the family will determine exactly how most of financing youre eligible for

This new HFA Prominent System provides guidance when it comes to a good forgivable 2nd financial that is possibly step three%, 4%, otherwise 5% of the first-mortgage. Additionally, there is an effective 20% annual forgiveness of mortgage for the entire five-year label.

HFA Advantage And additionally 2nd Mortgage

The fresh HFA Advantage Also Next Mortgage is almost identical to its cousin program, on the main distinction becoming it offers an excellent 0% deferred next financial as high as $8,000 which is forgiven for a price out-of 20% a-year for five years. This is exactly good choice for very first-day home buyers who’re on a single away from Florida Housing’s traditional fund.

Fl Home town Heroes Property Program

This new Florida Home town Heroes Housing Program aims to let people who bring beneficial functions on the teams, plus instructors, medical care gurus, police, firefighters, and you will experts. Qualifying individuals is discovered to 5% of your own first-mortgage amount borrowed, otherwise a total of $thirty five,000. (suite…)