And that is a powerful reasoning to enter

Yet, we really enjoy to your proven fact that new stories i give can be shape how the industry sees all of us. That there exists most people that will you will need to give stories On the united states, nevertheless these stories dont constantly let you know the world the fresh bits folks we wanted the country observe and you can learn. By reclaiming our own reports, because of the deciding on the tales we wish to tell, we could want to contour the community notices united states and knows our lives.

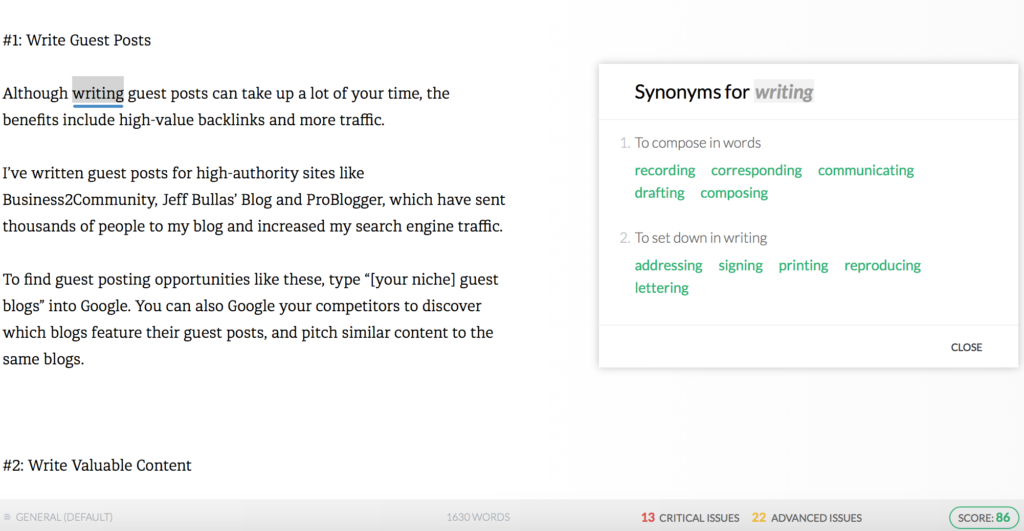

So when in the future while they has actually a few ideas, I have them composing

Making this where i begin. In advance of We previously inquire my personal children so you’re able to brainstorm story info, We begin by inquiring them next concern, What do you prefer the nation to know about your? To date, my college students have already over really works (inspired of the practical Sara Ahmed and her effective publication Be The alteration ) as much as name and performing name webs therefore the title bags you to We blogged on the within Post. Therefore we start by attaching it matter to that particular work and you may i quickly model some of the points that I might need other people to learn about myself once they would be to really understand whom I’m and you may understand living. It is vital to me which i design to possess my personal pupils a few of the more challenging items that Needs individuals see throughout the me personally. I would like students to feel secure sharing all of the components of exactly who he’s in our class and that i be aware that manageable to do that, I have to create me insecure very first. So, while i record things that Needs them to understand, We be sure to thought out loud on how two things was more complicated to generally share as opposed to others hence we may perhaps not all be ready to express the latest harder areas of ourselves, in case and when the audience is, creating try a manner in which we are able to do this. (suite…)

.png)