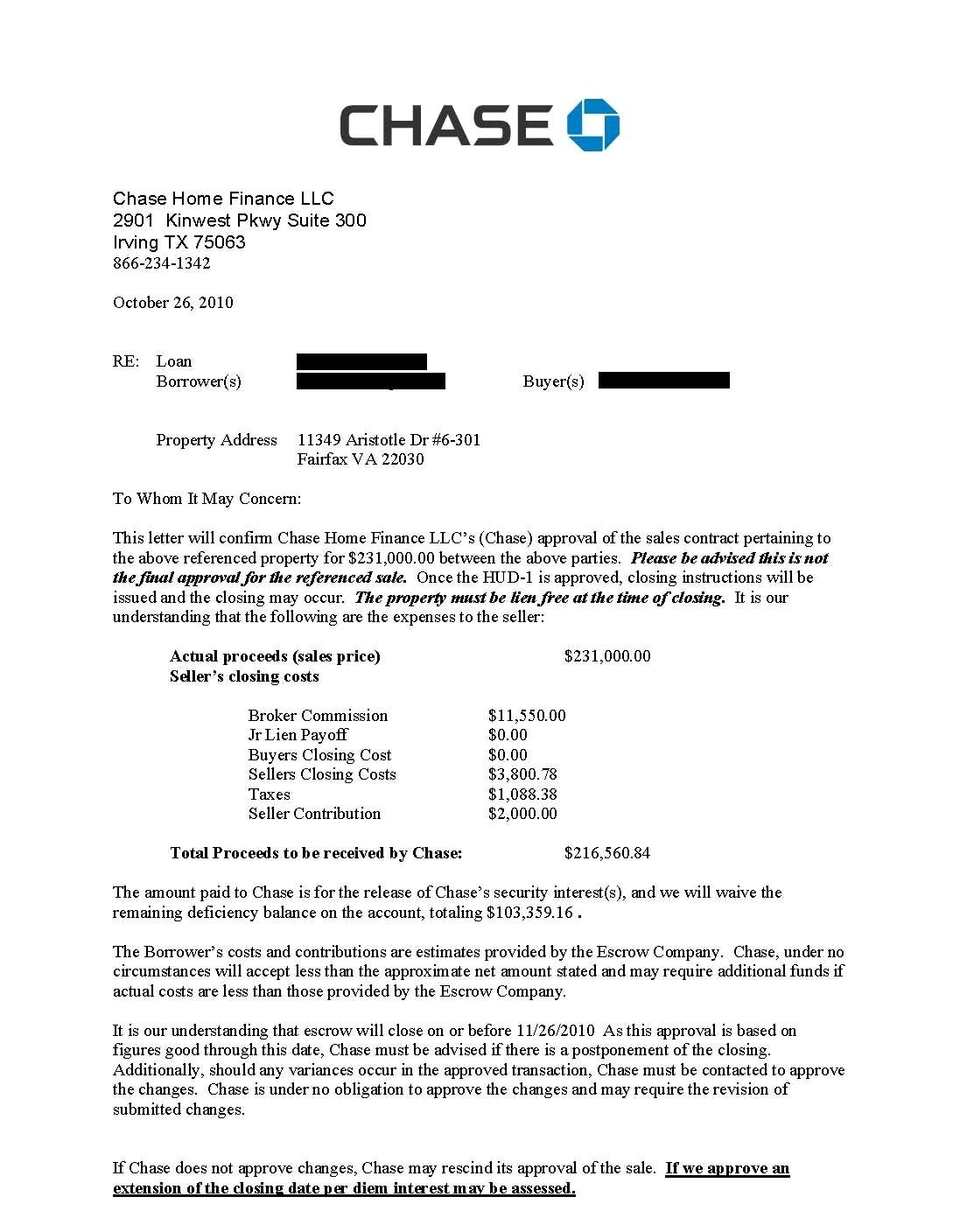

Previously, lenders are not enjoy individuals borrow 120% which have good guarantor home loan

Into the borrower

![]()

With a few lenders today, the maximum you could borrow are 105% of your own price otherwise 110% if you have expenses so you’re able to combine.

The majority of people aspiring to buy a property possess unsecured debt such as for example because the playing cards and private financing. If you find yourself in this situation, you will generally have the ability to consolidate obligations after you buy a home. Your own overall costs usually can end up being just about 5-10% of your cost.

Of numerous lenders cannot make it next home buyers to try to get a great guarantor loan, while they predict them to provides a powerful enough advantage condition to shop for a house on their own. This will be such as for example unfair to those that been through an excellent breakup otherwise problems, pushing these to offer its early in the day family.

Regardless if guarantor money allows you to use 100% of the price, of many lenders nonetheless require that you has 5% of one’s rate from inside the legitimate coupons.Meaning currency you have stored your self. Often a bank will accept a history of investing lease within the place of americash loans Winfield genuine offers.

Most other lenders lack a certain rules from it. Alternatively, their credit scoring system get refuse the loan based on your own investment condition relative to your earnings without having enough discounts.

Banking institutions examine those with a premier earnings and you can a reduced house reputation just like the high risk. Many young people invest their funds on the degree, a car, a wedding otherwise travelling and commence saving for a property simply after in daily life. (suite…)