Va Mortgage Federal Protect Qualification Unlocking Homeownership getting Put aside and you will National Shield Member

Put aside and you will National Guard professionals play a vital role within state’s protection, and in addition they are able to supply homeownership masters due to Va loans. Knowing the qualification conditions for Virtual assistant fund because the a person in the fresh new Federal Guard otherwise Set aside is essential for these seeking pick a home. In this educational and inventive writings, we are going to speak about just how Put aside and National Protect participants can acquire Virtual assistant financing, the fresh offered qualification requirements, borrowing from the bank and income requirements, the necessity of advancing years activities, requisite records, and you may valuable ADPI Expert Ideas to help you browse brand new Virtual assistant loan procedure.

How to get an excellent Va Loan because an excellent Reservist or National Protect Representative

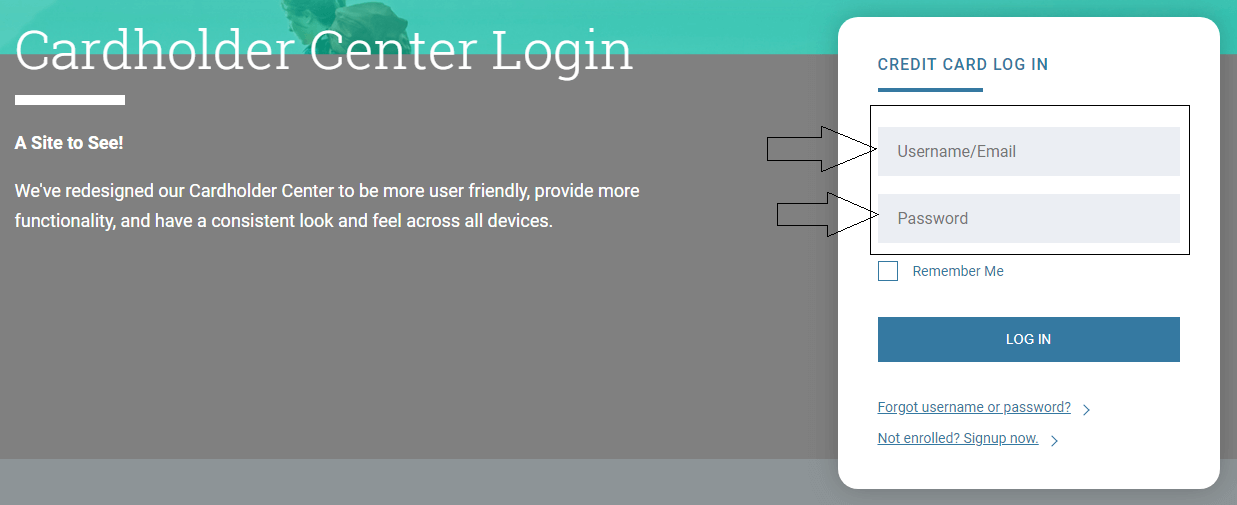

Because an effective Reservist otherwise National Shield user, getting a good Va financing requires satisfying particular qualifications standards. To start the process, you need to see the Certificate out-of Eligibility (COE) from the U.S. Agency away from Pros Situations. That it document confirms your own eligibility into the financing program. After you’ve your COE, you could run a beneficial Va-recognized bank who’ll make suggestions from app processes and you can direct you towards protecting an effective Virtual assistant mortgage.

Getting Your own COE since a member of this new Reserves or National Shield

Reserves/ Federal Shield, immediately after six numerous years of provider or that have an assistance-linked Va impairment, may score accredited sometimes. Be ready to show the point layer together with your financial. (suite…)