What performed I understand the my personal peer people created ranging from 1968 and you can 1973?

Conversation

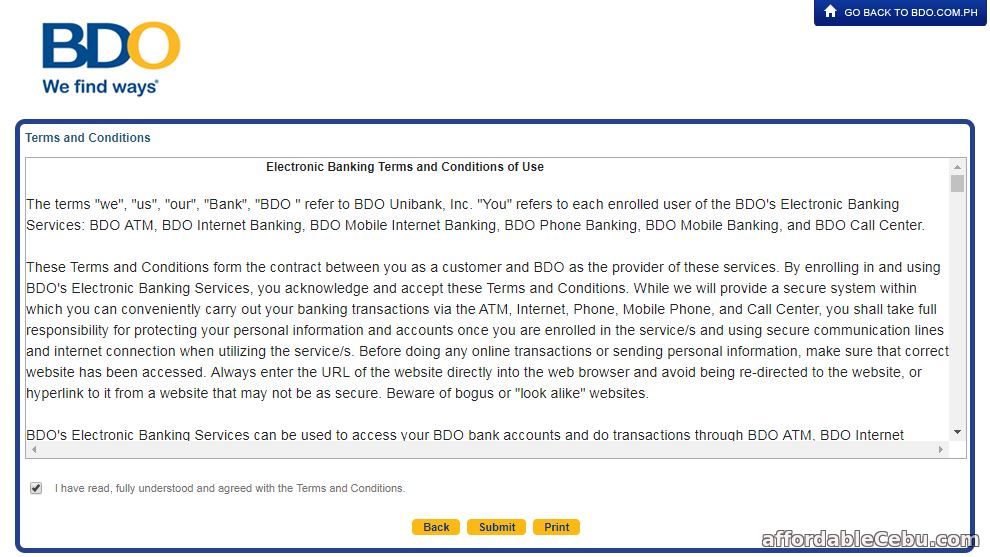

![]()

Basic, of many keeps attained the newest American desire homeownership and just have paid down out-of a home loan. Data in the ACS (20172021) integrated a nationally affiliate sample more than 50 thousand individuals who reach that milestone. Moreover, having fun with statistical questionnaire suggestions and you can testing weights provided by the fresh new census, the newest decide to try represents an estimated 1 million anyone across the You, together with 29 thousand pros whom said energetic-duty army services in the usa military between . Men and women homeownership numbers search promising to me, and you will coming performs you are going to see and you can establish whom such experts try in more detail. Second, a comparison of one’s unmarried-family home values of these pros signifies that, on average, experienced home prices was basically $31 thousand lower (10%) compared to those out of similar peers just who failed to serve. Given my expertise in waits immediately following service of wide range-building studies and homeownership situations, the real difference is actually in keeping with my sense and never shocking. Even after achieving homeownership rather than a mortgage, In addition observed extreme disparities home based viewpoints by the knowledge and race. Examining the detailed performance and showing to my attempt made me question perhaps the experienced updates of age-cohort peers generated the new disparities top otherwise tough. Its a question value investigating later on.

With this guidance, let us return to my substitute for volunteer toward Marines in the 1989 and have, Do understanding it huge difference determine my decision so you’re able to volunteer? (suite…)