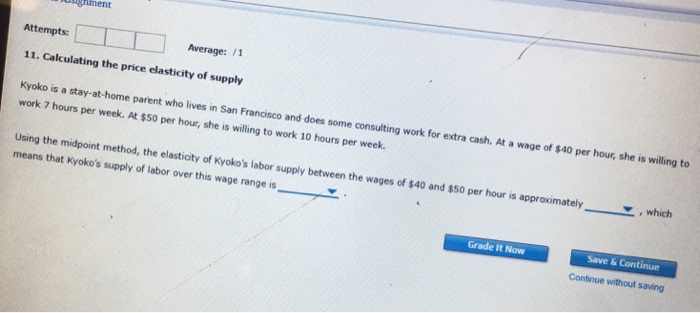

Financial freedom is simply a guaranteed mortgage out!

Even as we ready yourself so you’re able to commemorate the fresh coming off a different year, simple fact is that proper time to begin with a search to the monetary independence. Image an answer that not only handles your own quick cash conditions plus allows your financial investments in order to survive!

Which is exactly what 24×7 Money Up against Securities (LAS) can offer! Within this guide, we shall reveal exactly how a 24×7 Mortgage Up against Bonds will be debt mate. Capable help you in realising the fantasies, meet economic issues, and you will optimize your financial plan.

Benefits associated with 24x7LAS

LAS even offers quick use of financial assistance. This type of service makes you guarantee ties like offers, ties and you will Common Financing because the equity. For this reason, you should buy immediate cash versus selling your own ties, making sure disregard the portfolio stays intact.

Among the many master great things about 24×7 LAS was the performance. The loan acceptance and you can disbursement typically happens within a few minutes, that’s such as useful in issues. That it brief techniques mode you can address your own immediate financial need easily.

As opposed to liquidating investment, a great 24×7 LAS allows you to maintain your own assets while benefiting away from potential future gains, for example dividends otherwise incentives. It means you could continue to understand a full possible regarding their opportunities whilst they are bound. It is like getting the better of one another globes!

Since the LAS is secured against beneficial property, Axis Lender generally offers straight down rates of interest than simply Signature loans or Personal credit card debt. (suite…)