Of several play with Va-backed cash-away refinance funds to settle loans and for almost every other pricey can cost you, such degree

- You have got good COE.

- Your meet up with the lending requirements for money, borrowing from the bank, an such like. away from both your bank and also the Va.

- Lastly, might inhabit the home make use of the refinancing mortgage on the.

The same as other Virtual assistant-backed loans, people who meet the requirements can be acquire to the newest Federal national mortgage association/Freddie Mac computer conforming loan limit in most areas whenever forgoing good downpayment and much more compared to the restrict whenever an all the way down percentage is established.

Refinancing was a complex creating and it’s really important to work at a real estate agent and you may financing officer to greatly help make suggestions through the processes.Closing costs could cost thousands of dollars and they are an option consideration to speak with your own agent planning to feel sure you’re in a position so you can re-finance.

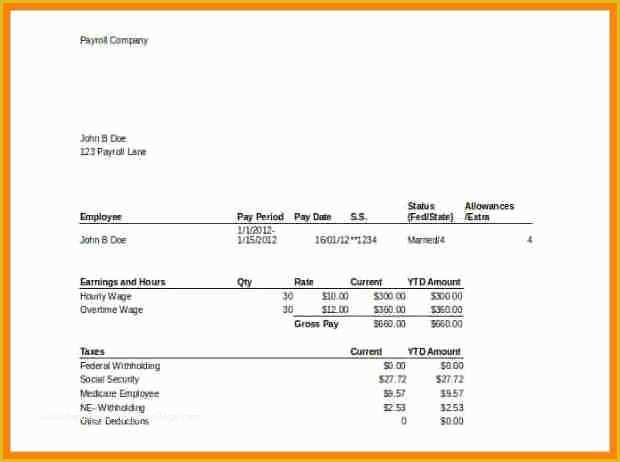

In addition, the latest Seasoned inhabitants can often be focused of the those individuals trying to grab advantage of their benefits. Definitely stand vigilant and you will make homework, like off extremely glamorous terms.VA-recognized dollars-away re-finance finance arrive as a result of individual loan providers, thus you’ll want to find one and offer the COE together together with other monetary records, particularly paycheck stubs (past thirty days), as well as the history 2 years of your own W-2s and you will tax statements.

Homeless Seasoned Benefits

Pros against homelessness don’t have to think about it alone as a result of the brand new Virtual assistant and you can outside resources purchased permitting Vets obtain reliable protection and you may a position.

Stand down Apps is actually grassroots apps that may give assist to own homeless Vets however they are not run from the Virtual assistant. (suite…)