House Equity Loan Pricing inside Delaware ()

The current house security mortgage rates for the Delaware to own 10-seasons funds average eight.7%, complimentary the fresh new federal rates. To possess fifteen-12 months financing, Delaware’s average 8.2%, slightly above the federal rate from eight.9%.

By the Zachary Romeo, CBCA Examined from the Ramsey Coulter Edited of the Nica Gonzales-Villaraza Of the Zachary Romeo, CBCA Analyzed because of the Ramsey Coulter Edited by Nica Gonzales-Villaraza On this page:

- Newest De HEL Pricing

- De HEL Costs because of the LTV Ratio

- De- HEL Rates by Urban area

- De- HEL Lenders

- The way to get a loans Montevallo AL knowledgeable HEL Rates

- FAQ

The fresh new security of your home that you can access and you may obtain is known as tappable security. A house security loan (HEL) helps you optimize your home guarantee, regardless if you are trying finance do it yourself ideas otherwise consolidate personal debt.

Delaware’s domestic collateral mortgage costs is actually some more than federal averages – eight.7% Annual percentage rate to possess a good ten-12 months name (seven.7% nationally) and you can 8.2% Annual percentage rate to own good fifteen-year name (eight.9% nationally). We now have accumulated detail by detail understanding towards newest domestic equity loan pricing within the Delaware, and city-particular prices, finest lenders and you can tips about securing the best cost for using your residence’s equity.

Secret Takeaways

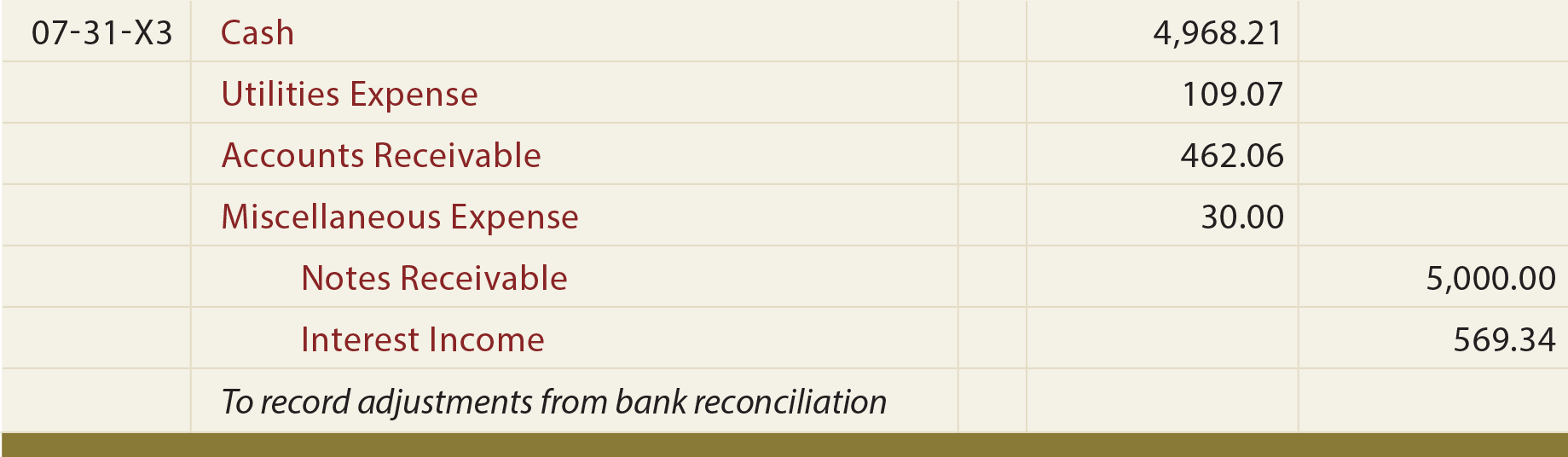

High LTV ratios trigger higher pricing. An average Apr to have a good fifteen-season HEL inside the Delaware which have an enthusiastic 80% LTV are eight.9%, compared to 8.7% for good 90% LTV.

HEL costs will vary by the town inside Delaware. Particularly, to own 15-season loans, Greenville enjoys the common Apr from 8.0%, while Claymont’s try nine.8%. (suite…)